Rates Rebate

Do you want up to $790 off your rates?

You may be eligible if:

- you are the legal ratepayer for your property

- your property was your place of residence on 1 July 2024

- your property is not used principally for commercial, industrial, business or farming purposes

- you apply between 1 July 2024 and 30 June 2025

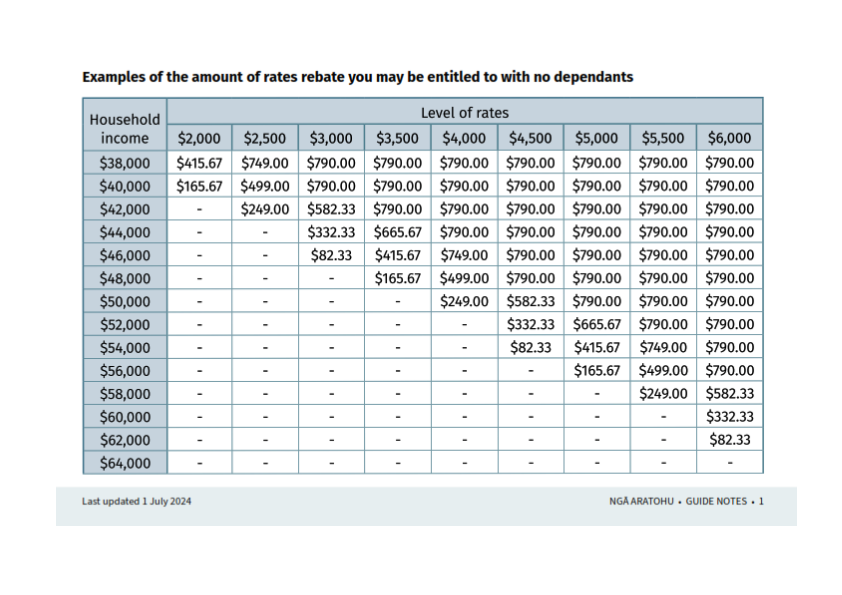

The table below shows examples of the amount or rates rebate you may be entitled to with no dependants. For example, if your income is $46,000 and your rates are $3,500, you will get a partial rebate. NB. if you have dependants living with you, the amounts could be higher.

Indicative 2024-2025 Rates Rebate

See Larger Version of This Table

What is a Rates Rebate?

The Rates Rebate Scheme was established by Government in 1973 to provide a subsidy to low income home owners on the cost of their rates.

Council administer the Scheme and is reimbursed by the Government for all rates rebates.

A rates rebate is a partial discount on a rates bill — you pay less for your rates.

If you own your home and are on a low income, you may be eligible for a rates rebate.

Do you Qualify for a Rates Rebate?

You may be eligible for a rates rebate for the 2024 / 2025 rating year if:

- You are the legal ratepayer for your property

- Your property was your place of residence on 1 July 2024

- Your property is not used principally for commercial, industrial, business or farming purposes

- You apply between 1 July 2024 and 30 June 2025

To check what your entitlement might be if you provide the above details to Council by telephone or over the counter at one of our offices, we can quickly calculate whether you qualify for a rates rebate, and if so, how much you would be entitled to or you can use the online rates rebate calculator.

Go to DIA rates rebate calculator

How to Apply for a Rates Rebate

Applications for this financial year are open.

Apply in person at Council’s Customer Service Centre in Blenheim or at the Picton Library or click on ‘Rates Rebate application form‘ at the bottom of this page to apply online.

Proof of Income

If you have proof of income, this can include:

- Income confirmation from Work and Income or Inland Revenue.

- Investment earning statement for the tax year ending 31 March 2024.

- Statement of earnings from your employer

Proof of Self-Employed Income

If you are self-employed, you need to provide satisfactory proof of income for the tax year 1 April 2023 to 31 March 2024. This includes:

- A copy of your complete set of financial accounts, or

- The IR3B or IR10 from you provided to Inland Revenue.

Business losses cannot be offset against other income.

When Do I Apply?

Applications for this rating year close on 30 June 2025; no late applications will be accepted.

Want to Know More?

Please visit or phone Council on phone 03 520 7400 and talk to one of our Customer Services Officers or you can email ratesrebate@marlborough.govt.nz or have a look at the Department of Internal Affairs (DIA) website to use a calculator to determine any entitlement and see some examples based on different rate levels, income levels and the number of dependents.

Go to DIA rates rebate calculator

Contact Details for Proof of Income

| Contact | Type of income | Phone |

|---|---|---|

| Work and Income | New Zealand Superannuation | 0800 552 002 |

| Work and Income | People under 65 | 0800 559 009 |

| Inland Revenue | Personal Tax Summary Go to the IRD website to request a summary of income | 0800 257 777 |

| Working for Families | Tax credit Go to the IRD website to view working for families payments | 0800 227 773 |

Maximum Rates of Work and Income Benefits Table

The DIA table in the pdf below is a guide only to help determine the income of applicants receiving NZ Superannuation or a Work and Income benefit for tax year ended 31 March 2023.